CXC CSEC Principles of Accounts (POA) - Balance sheet calculations

CXC CSEC Principles of Accounts (POA) - Balance sheet calculations

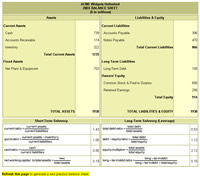

Here is an interactive demo of a company's balance sheet showing how to calculatethe various data types in Accounts e.g. cash ratio, debt -ratio etc...

Re: Principles of Accounts - Balance sheet

whats another name for cost of stock sold? is it cost of sales??

Re: Re: Principles of Accounts - Balance sheet

Another name for cost of stock sold is closing stock

ANSWERING WAT IS FIXED ASSETS

FIXED ASSETS ARE ASSETS THAT ARE IN THE BUSINESS FOR A LONG PERIOD OF TIME EXAMPLE BUILDING PREMISES MACHINERY AND FIXTURES AND FITTING YOU MUST ALSO PLACE THEM IN ORDER FROM THINGS THAT ARE HARD TO SELL OFF

POA

NEED HELP WITH THIS QUESTION.wHERE AND HOW DO I PUT THIS IN THE CASHBOOK.AUG 6 -Sold goods on credit to B.Sediment for $8000.00 offering a 2% cash discount for payment before the end of the month. On Aug 29 received a cheque from B.Sediment in full settlement of account.How do I put this in the Cashbook.

answer to question

Debit cash 7840, 160 discount allowed. This is done since the payment was made before the month was completed.

POA

Hey Admin, thanks for posting the balance sheet and especially those ratios. I've been having a bit of trouble with those and it looks like a lot of help to me. It's straight forward and very easy to understand.